Fiska S., Usanti T.P. The characteristics of imposition of pledge on the trademark rights in Musharakah financing

УДК340.1(594)

THE CHARACTERISTICS OF IMPOSITION OF PLEDGE

ON THE TRADEMARK RIGHTS IN MUSHARAKAH FINANCING

Fiska S.,Usanti T.P.

This article describes the characteristics of the pledge on the right of trademark which is imposed on obligations in Islamic banks. Based on the research, in practice, it is very rare that an Islamic bank accepts the rights of trademark as an object of collateral or pledge with some reasons. One of the Islamic bank, which received the rights of trademark as pledge or collateral for Musharakah financing, namely Bank Muamalat Indonesia. This bank imposes a pledge on a right of trademark and it is different from Bank Negara Indonesia, which prefer imposition Fiduciare Eigendom Overdracht (hereinafter referred to as FEO) or fiduciary transfer of ownership in their financing. Pledge is favourable and it has more advantages in its characteristics for banks and debtors as compared to FEO. Pledge has simple mechanism and its perform execution. In addition, pledge is more efficient especially in terms of cost. Furthermore, in mechanism of the pledge, there is no registration and it is not necessarily in the form of authentic deeds, while in FEO mechanism, there is obligation to register electronically (by online) and original documentation is required. On pledge there is no duty to rescission, but in FEO, there is such a mechanism.

Keywords: trademark certification, pledge, Musharakah, Islamic bank, trademark right, Civil Code, article 1150, Indonesia.

ОСОБЕННОСТИ ПЕРЕДАЧИ В ЗАЛОГ ПРАВА

НА ТОВАРНЫЙ ЗНАК ПРИ ФИНАНСИРОВАНИИ МУШАРАКИ

Фиска С., Усанти Т.П.

В данной статье описываются особенности передачи в залог права на товарный знак как способ обеспечения исполнения обязательств в исламских банках. Исследование показывает, что на практике очень редко исламский банк принимает право на товарный знак в качестве предмета поручительства или залога в силу ряда причин. Одним из исламских банков, получившим право на принятие товарного знака в качестве залога или поручительства для финансирования мушараки, является Банк Муамалат (Индонезия). Этот банк принимает в качестве залога право на товарный знак, что отличает его от Банка Негара (Индонезия), который предпочитает навязывание передачи фидуциарной собственности (ПФС) при ее финансировании. Залог предпочтителен и имеет больше преимуществ по своим характеристикам для банков и должников по сравнению с ПФС. Залог имеет простой механизм внесения и исполнения обязательств. Также залог является более эффективным, особенно с точки зрения стоимости. Кроме того, в механизме залога отсутствует регистрация, и он не обязательно должен быть оформлен с использованием оригинальных документов, в то время как в механизме ПФС существует обязанность регистрироваться в электронном виде (через Интернет) и необходимо наличие подлинной документации. По залогу нет обязательств по расторжению, а в ПФС есть такой механизм.

Ключевые слова: сертификация товарного знака, залог, мушарака, исламский банк, право на товарный знак, гражданский кодекс, статья 1150, Индонезия.

Introduction

The right of trademark as a moveable and intangible object can be used for an object of bank collateral credit facility because it qualified as collateral object. In practice of Islamic Banking Bank Muamalat Indonesia (hereinafter referred to as BMI) accepts the right of trademark as collateral object of musharaka financing. There is also some collateral institution under it, that is mortgage collateral company, not a Fiduciare Eigendom Overdrach Company as what applied in PT BNI according to the observation of Sri Mulyani [7, p. 139].

Principally, the right of trademark as movable and intangible object has a possibility to be burdened with Mortgage Collateral Company or fiduciary guarantee. This statement referred to article 1150 of Civil Code:

Pledge is “a right that is acquired by a creditor against to moving goods, bodied and bodiless given to him by the debtor or any other person on his behalf to guarantee a debt, and which authorizes the creditor to obtain repayment of goods the precedence over other creditors with the exception of the costs to auction the item and the cost incurred to maintain it, the costs of which should come first” [4].

Fiduciary Security defined by article 1 number 2 Law number 42/1999. It explained that: “Fiduciary Security in Indonesia is defined by Law number 42/1999 on Fiduciary Security (Fiduciary Law) as the right covering moving objects both tangible and intangible and immovable objects which cannot be encumbered with a mortgage” [2] as what governed on Law number 4 of 1996 about Hak Tanggungan will still under authorization of Fiduciary giver, as collateral for certain repayment, which gives authority and prioritized for fiduciary recipients to other creditors.

Although both of guarantee companies have same license agreement, they have different characteristic:

Characteristic of Musharakah financing

Generally on distributing financials to client, Islamic Bank has four characteristics:

1. Financing with the principle of profit sharing (Mudharabah and Musyarakah).

2. Financing with the principle of buying and selling (Murabahah, Salam and Istisha).

3. Financing with the principle of rent (Ijarah and Ijarah Muntahiya Bittamlik).

4. Financing with the principle of borrow (Qardh).

Musyarakah agreement is a cooperation agreement between two sides or more for certain business and each side giving funds in certain portion with certainty of profits will divide as the deal, while the damage burdened according to each own modal portion. Other term for syarikah is Musyarakah which means a partnership of two or more people dividing the profit and damage according to the first agreement from every side. Therefore on financing Musyarakah by Islamic Banking, they paid it as part of business modal and Islamic Bank could be a part of those company management, then there needs an agreement to provide it certainty. However practically in Islamic Bank, all the management manages by client.

In Musyarakah financing, profit sharing can be done based on the amount of modal portion or can be done based on the deal which already being agreed by every side. While the damage, will be burdened according to the portion of their modals. The difference of this determination happens because of the difference from absorption of profit and damage. Every profits could be absorb by every sides, while any damages not every sides has the same ability of absorption. Thus, if there any damage happens, the amount of damage will be burdened based on the amount of their invented modals [see: 5].

Islamic Bank will get their profit from the result of musharakah financing in form of syirkah al-inan. On the application of Islamic banking, musharakah financing usually applied for client project. After the project finish, based on the criteria on musharakah financing agreement, therefore client have to refund the money long with shring profit with Bank. Musharakah payment that distributed by BMI for food and beverages business and guarantee objects of that payment is the brand of business itself.

Mortgage encumberedfor the right of trademark

According to Burgerlijk Wetboek (BW) (the Civil Code of the Netherlands) article 499, based on the law understanding, assets is every object and every right which controlled by the right of ownership [6]. The right of trademark categorized as an object, a movable intangible object. Arthur S. Hartkamp defined the right of trademark as an agreement for product of thought: “It was originally intended to devote the last book of the Code (Book 9) to the third category of subjective patrimonial rights: "the rights on the products of the mind". The statutes containing these rights (at that time: patents, trade mark, copyright, trade name) were to be split up. The provisions of a civil character would be included in Book 9, those of an administrative, procedural and penal character were to be placed elsewhere” [3, p. 1072].

Beside as requirement of pledge object, the right of trademark has an economical value which can be transferred as long as it fulfilled the requirements as below [8, p. 419]:

a. Financial reports of company from the owner of trademark to make sure whether those right of trademarks have value or not.

b. The right of trademark comes from familiar brand. It means that those trademarks owned by the brand that has been known by most people (consumer). Referred to Haedah Faradz explanation [1, p. 40], to make a brand famous and able to achieve the quality or reputation of certain product is not easy and need a lot of time. Coca Cola from US needs 100 years for it.

c. The right of trademark can be used as pledge object if that right is already registered on general list of the right of trademark in Directorate General of Intellectual Property, Ministry of Law and Human Rights Republic of Indonesia. It can be proven by having right of trademark certificate; therefore the right of trademark has a law protection for 10 years period since the receipt date and those periods can be extended.

Mortgage guarantee institution has characteristic, that pledge agreement include as valid if a pledge objects are under control of creditor or under control of third party as what written on Article 1152 sentence (1) and (2) of Civil Code [6]:

– Pledge agreement of moving objects and accounts receivable will be put within the pledge object under control of the lender or third party, and has been agreed by both of sides.

– Pledge agreement considers void if the objects or properties still under control of pledgee, or pledger retrain the object or properties as pledgee’s consent.

Those statements called as inbezitstelling. And this was done to guarantee the position of creditor and damage risks; in case there will be occur a thread of fraud from debtor to isolate their guarantee objects. Handing over pledge object to creditor or third party who has been agreed is not included as juridical assignment (levering) in this case there is a transferring ownership from creditor to debtor. Those assignments are required for property rights or known as pledge agreement. Therefore functions of Inbezitstelling are:

a. Signal for the existence of property rights.

b. Entity of the principle of Publicity.

c. Pledge agreement is a valid agreement.

d. Reflection of pledge validity.

e. Form of law protection for creditor (pledge holder).

On pledge, the principle of publicity does not mean has to be registered on general register, but publicity principles on pledge have to be taken from the owner and given to creditor or third party as existence of publicity principles.

Inbezitstelling is a law protection for creditor, because pledge object is a moving object. As the current principles for moving object inside article 1977 paragraph (1) of BW Civil Code: “Toward movable object unless bank interest, even accounts receivable that have no authority to be paid to the first owner, therefore who has control of those, consider as the owner” [6].

Thus, if a pledge object stay under control of its owner, the owner will easily gave those objects whereas the object is already being pledge. Therefore it will damage for creditor who already give a loan.

With an inbezitstelling system, there will be rights for object which has been pledged cannot be pledged again by other creditor, because if it being pledge to other creditor, the first creditor has to retrains the possession of pledge from the first creditor in order to make pledge become valid. The legal consequences of pledge retrains from the first holder authority, the agreement will be deleted as what referred on Civil Code BW article 1152 paragraph (3) [6].

Besides, on pledge is not required for having authentic agreement. Therefore, pledge agreement can be only signed agreement or an authentic form. As what referred on BW Civil Code article 1151 [6]. Pledge agreement should be proven by an object that allowed for proving the main agreement. Practically, BMI uses authentic agreement on encumbered pledge for the right of trademark.

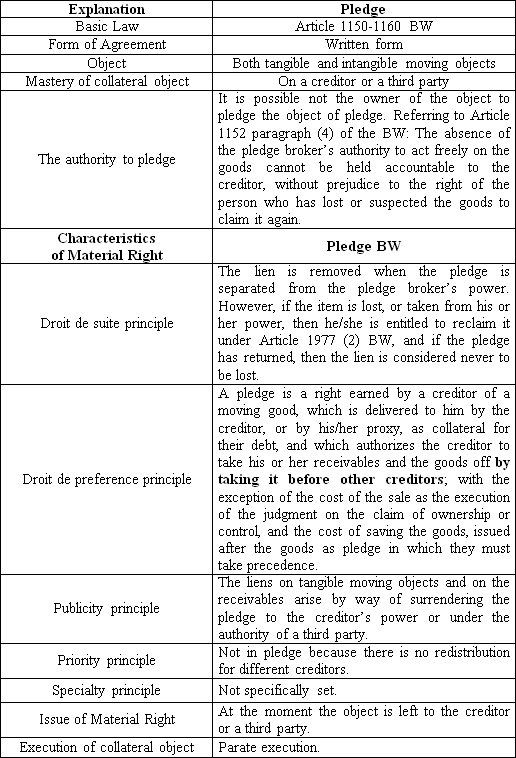

Figure 1.

The characteristics of imposition of pledge on the trademark rights

Based on the description above, it indicates that pledge institution is a simple system and more efficient on cost. This is happen because there are no requirements for authentic pledge agreement therefore signed agreement consider enough. Other requirements for material rights on pledge, the pledge object being transferred to creditor as third party, thus creditor position is preferred creditor.

The execution of pledge object is quite simple, Parate execution has been provided by law in order to prevent debtor for doing breach of contract as what referred on BW Civil Code article 1155 [6]. If all promised side has another deal, debtor does not have to fulfill his obligation, after the period time passed, or after a warning of settlement. if there is no regulation for the right period, creditor have the right to sell their pledge property in public according to local custom within the common requirements, therefore, the amount of debt with interest and other cost can be paid off with those sales result. If those pledge objects contain of market object or can be sold within trading market, selling process can be done in that same place under two realtors who has been expert on it field as mediator. Civil Code article 1155 is an article to govern. Thus, every side is free to make other decision if that decision still appropriate within Civil Code article 1155. Parate Execution in pledge exist because law does not need any agreement. Without executorial title, creditor can carry out the pledge selling without asking help from court, and does not need help from bailiff.

After the execution for the right of trademark and sales outcomes uses as debt repayment from debtor, the next step is applied for the rights transfer agreement to Directorate General of Intellectual Property Right. Fulfill the requirement of Application Letter of transferring the trademark typed in two papers by applicant or their lawyer as Property Rights consultant in Directorate General with Indonesian Language and directed to the Director of Trademark’s rights, General Director of Intellectual Property Rights, Ministry of Law and Human Rights of Indonesia. Pledge does not need a removal of Pledge on General Register because in pledge. Because in pledge, there is no requirements for registering pledge therefore a pledge agreements automatically removed if the main agreement being removed as the characteristic of accessories from pledge agreement.

Conclusion

The right of trademark can be encumbered with Mortgage Guarantee Company or Fiduciary guarantee. Practically, in BMI the right of trademark encumbered with Mortgage Guarantee Company to cover up musharakah financing. Characteristic of pledge guarantee such as: there is no requirement for guarantee certificate as authentic form, existence of material rights by giving a pledge object to creditor or third side, simple execution for pledge object by parate execution.

Bibliography:

1. Faradz H. Perlindungan Atas Hak Merk // Jurnal Dinamika Hukum. 2008. Vol. 8. No 1. P. 38-42.

2. Fiduciary Security in Indonesia Explained [Web resource] // Indonesia Investments. 2019. URL: http://bit.ly/2Fjx9lo (reference date: 20.12.2019).

3. Hartkamp A.S. Civil Code Revision in the Netherlands: A Survey of Its System and Contents, and Its Influence on Dutch Legal Practice // Louisiana Law Review. 1975. Vol 35. No 5. P. 1059-1090.

4. Here are two alternatives execution of pledging of shares [Web resource] // BP Lawyers. 16.02.2017. URL: http://bit.ly/35qkoQp (reference date: 20.12.2019).

5. Karim A.A. Bank Islam: Analisis Fiqh dan Keuangan Penulis. Jakarta: Raja Grafindo Persada, 2010. 528 P.

6. Kitab Undang-Undang Hukum Perdata (Burgerlijk Wetboek voor Indonesie) [Web resource] // Universitas Sam Ratulangi. 2019. URL: http://bit.ly/2MVzreF (reference date: 20.12.2019).

7. Mulyani S. Realitas Pengakuan Hukum Terhadap Hak atas Hak Atas Merek Sebagai Jaminan Fidusia Pada Praktik Perbankan // Jurnal Hukum dan Dinamika Masyarakat. 2014. Vol. 11. No 2. P. 135-148.

8. Usanti T.P. Analisis Pembebanan Gadai atas Sertifikat Merk pada Bank Syariah // Mimbar Hukum. 2017. Vol. 29. No 3. P. 415-429.

Data about the authors:

Fiska Silvia – Doctor of Law, Lecturer of Department of Law, Airlangga University (Surabaya, Indonesia).

Usanti Trisadini Prasastinah – Doctor of Law, Lecturer of Department of Law, Airlangga University (Surabaya, Indonesia).

Сведения об авторах:

Фиска Сильвия – доктор юридических наук, преподаватель юридического факультета Университета Аирлангга (Сурабая, Индонезия).

Усанти Трисадини Прасастинах – доктор юридических наук, преподаватель юридического факультета Университета Аирлангга (Сурабая, Индонезия).

E-mail: trisadiniprasastina@gmail.com.

This work is licensed under a Creative Commons Attribution 4.0 International License.

This work is licensed under a Creative Commons Attribution 4.0 International License.